‘I’ve got $7 a day to live on’: Young Americans are taking part in a viral trend called 'loud budgeting' — something Suze Orman has promoted for years. But could it work for you?

It’s not even February and Gen Z has already created a new financial trend: “loud budgeting.”

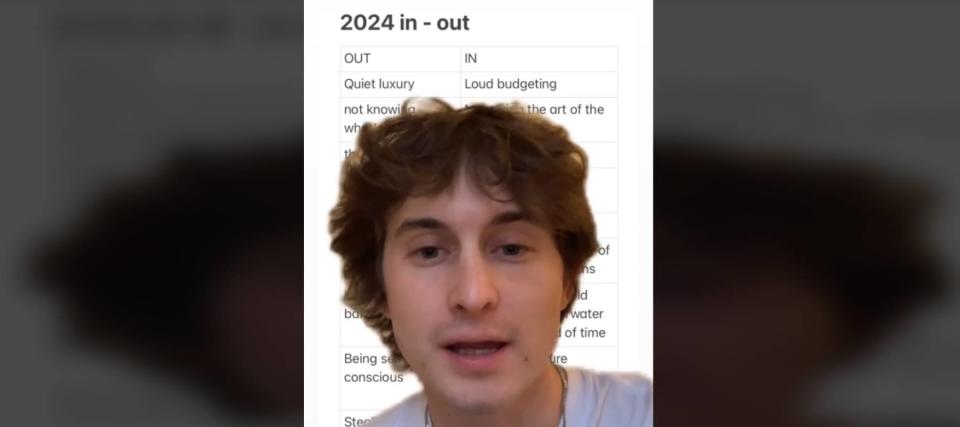

The youngsters can thank TikTok influencer Lukas Battle for the term. Battle coined it in a video late last year where he shared his list of what’s “in” and what’s “out” for 2024.

Don’t miss

Take control of your finances in 2024: 5 money moves to start the new year off strong

Robert Kiyosaki warns: ‘Cash is trash’ — Discover the power of diversifying with gold now

She bought an ‘unlivable’ house for $16,500 and made it her dream home — but you can reap the rewards of today’s expensive housing market without all the heavy lifting

According to Battle, quiet luxury is “out” while loud budgeting is “in.” Loud budgeting is exactly what it sounds like: loudly declaring that you can’t afford something because it’s not in your budget.

Appropriately, the concept was received with exuberant fanfare online — so much so that Battle made a follow-up video (that also went viral) explaining the concept in detail.

“Loud budgeting has the same feeling as sneaking candy into a movie theater. You feel like you got away with something,” Battle explains. “If you know any rich people, you know that they hate spending money. So it’s almost more chic, more stylish, more of a flex.”

But while the name might be new to you, the concept of loud budgeting has been around for a long time — and has attracted big-name supporters like Suze Orman, the money maven herself.

Suze Orman for a new generation

For years, Suze Orman’s been encouraging her followers to be open and honest about their financial restrictions — especially with loved ones.

Most recently, Orman has been pushing parents to stop supporting their adult kids because it often cuts into their retirement savings. She told Moneywise in May 2023 she even gave parents a script for effectively loud budgeting their way out of paying for their kids:

“I am no longer your bank account! I'm getting to the point where I need my money to be able to support myself. You are old enough now to go out and figure it out. So don't come to me for money.”

Orman’s not the only money maven encouraging parents to put their needs before their children’s.

“It is irresponsible of a parent to not be 100% set up for retirement if they have kids, because then it forces them to be financially responsible for their parents,” YouTuber Caleb Hammer warned his viewers on his show.

Though it may seem cold to put your financial needs first, you’re really doing your kids a favor in the long-term. It’s like putting on your oxygen mask first: you have to take care of yourself first or you won’t be able to help anyone else.

Read more: Retire richer — why people who work with a financial advisor retire with an extra $1.3 million

How to practice loud budgeting

Loud budgeting using the Orman playbook is easier said than done. However, Battle thinks his lighter approach to it should make it easier to practice.

“It was meant to be a funny idea that allows people to be financially transparent without feeling embarrassed,” he told Buzzfeed. “I think being honest and realistic about money should be considered stylish and cool.”

For instance, Battle doesn’t just say “I can’t afford to go out to dinner tonight.” He says: “Sorry, can’t go out to dinner, I’ve got $7 a day to live on.”

It may seem blunt, but there’s long been a shame associated with not having as much money as others. By addressing it directly with a bit of tongue-in-cheek humor, Battle breezes right past any embarrassment — and makes it clear he’s prioritizing his own financial stability.

As debt levels continue to rise, embracing the concept of loud budgeting could help countless other Americans. There’s no need to come up with an excuse for why you’re not available if you can just honestly admit you don’t have the cash flow to dine out tonight.

So although loud budgeting might be a funny way to start taking your savings seriously, you may find you’re laughing all the way to the bank.

What to read next

Thanks to Jeff Bezos, you can now cash in on prime real estate — without the headache of being a landlord. Here's how

Find out how to save up to $820 annually on car insurance and get the best rates possible

Millions of Americans are in massive debt in the face of rising rates. Here's how to take a break from debt this month

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.